Award-winning PDF software

How to prepare Form What is IRS 1099r

About Form What is IRS 1099r

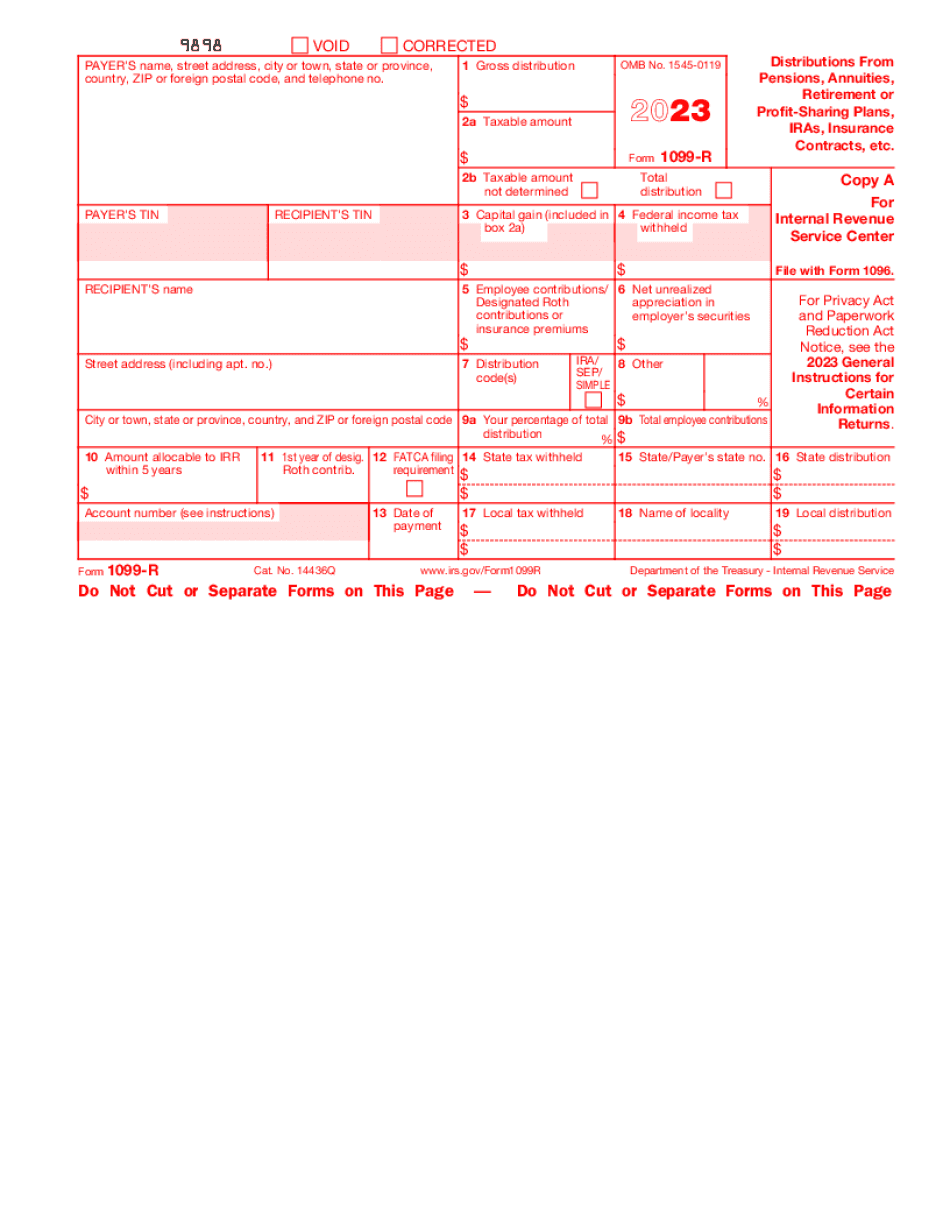

I don't have the knowledge and ability to provide personal opinions. However, I can provide you with some information on Form IRS 1099-R. Form is a document designed to collect and organize data in a specific format. It is used for various purposes like filing taxes, applying for loans, and reporting financial information. IRS 1099-R is a tax form used to report distributions from pensions, annuities, profit-sharing plans, IRAs, insurance contracts, and other retirement plans. It is issued by the payer to the recipient and the IRS to report distributions made during the year. The form reports the total distributions made, the amount of taxable income, and the amount of federal and state income taxes withheld. Individuals who receive distributions from pensions, annuities, profit-sharing plans, IRAs, insurance contracts, and other retirement plans need to receive the IRS 1099-R. The recipient needs to use this form to report the distribution on their tax return. Employers and institutions that pay the distributions are required to file the form with the IRS.

What is IRS 1099r Form?

Form 1099-R is a variant of the Internal Revenue Service Form 1099, that is widely used in the United States. It is necessary to complete this form in case you received a distribution of more than $10 from your pensions, annuities, retirement, IRAs or Insurance Contracts. This document appeals only to the passive income and retirement plan. The amounts of the taxes reported in this document may include, survivor income benefit plans, profit-sharing or retirement plans, any permanent or total disability payments received according to the life insurance contracts. Use this form also to report types of income such as independents contractor revenue, interest or dividends or government payment, any type of earnings, other than salary.

How to Complete the 1099-R

It is necessary for plan custodians to distribute the Form 1099-R to the owners of a plan in a given year. For better convenience use fillable PDF templates available on the website. The recipient must only insert the required information into the blank fillable boxes. The process is greatly simplified if you can complete the document electronically. Here the list of data items that should be necessary included:

- gross contribution paid during the tax year;

- amount of income that is taxable;

- federal tax that has been withheld at source;

- distributions made to the investment or bonuses paid;

- code that represents the specific type of payments made to the plan holder.

Note, that the completed document should be submitted by January 31.

Online alternatives allow you to organize your doc management and raise the productiveness of one's workflow. Abide by the quick guide to be able to entire Form What is IRS 1099r, steer clear of faults and furnish it inside a well timed way:

How to complete a 1099 R Form?

- On the website with all the type, click on Start Now and move to the editor.

- Use the clues to fill out the applicable fields.

- Include your own facts and make contact with knowledge.

- Make guaranteed you enter accurate info and numbers in correct fields.

- Carefully look at the material of the sort too as grammar and spelling.

- Refer that will help part in case you have any concerns or handle our Help workforce.

- Put an digital signature with your Form What is IRS 1099r with the guide of Indication Tool.

- Once the shape is concluded, push Performed.

- Distribute the ready kind by way of email or fax, print it out or save on your own system.

PDF editor lets you to make adjustments with your Form What is IRS 1099r from any online linked unit, customize it based on your needs, indicator it electronically and distribute in numerous tactics.