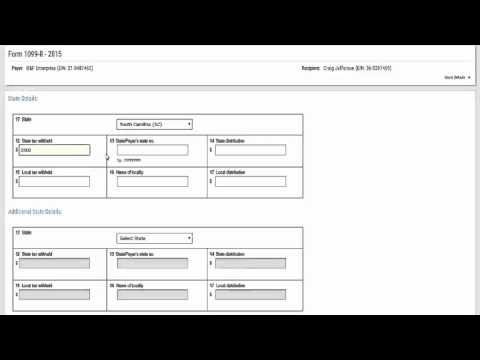

Welcome to Express IRS forms. Quickly file your 1099 and W-2s through IRS authorized Express IRS forms and successfully transmit them to the IRS in just a few steps. On this page, proceed to enter details by filling in distributions and withholding information for each applicable state. You may also add information for multiple states for the form 1099. First, select the state to which you want to report payment information in 12. Report any state tax withheld on payment if your state participates in the CF SF program or requires paper filing of the 1099 with your state tax department in 13. Enter your state payer number in this section if you have any state tax information to enter. If state or local income tax was withheld from the distribution, enter information in 14 and 17. In 14, indicate the part of the distribution subject to state and/or local tax. Enter the total state distribution in this field. In 15, enter the local income tax withheld on the payments reported on this form. In 16, enter your locality name and in 17, enter the total local distribution. Please note, if you have to furnish state information for more than two states, you will need to complete another 1099-R form. If you have any questions or need further assistance in providing state information on form 1099-R, please feel free to contact our dedicated support team here in Rock Hill, South Carolina at 704-839-2270 or send us an email to support@ExpressIRSforms.com.

Award-winning PDF software

1099-r distribution code 1m Form: What You Should Know

IRS Form 1099-R Box 7 (Roth IRA) 20 Dec 2025 — For a Roth IRA, enter code 1, Standard deduction, to report a standard deduction (with an aggregate value of 18,000 or less), even if you IRS Form 1099-R Box 7 (Roth 401k) 31 Dec 2025 — Enter code J, Modified adjusted gross income, to report the modified adjusted gross income. This is the adjusted gross income (AGI) of the beneficiary of a 401k plan for which you are the plan administrator. Enter code 0 to report a zero AGI for the beneficiary of a 401k plan, if the beneficiary is a taxpayer living in a foreign country and does not receive any form 1099-R, 1095-R, or 1099-RN. 15 Apr 2025 — The code G is the nonstandard distribution (1099-Q). What if I got my money with a check? — Turbo Tax Support 16 Oct 2025 — The code G is the nonstandard distribution (1099-Q) and has to be reported with an 8% computation. 15 May 2025 — The code G is the nonstandard distribution (1099-Q), except if you received a 1099-Q with a 9% computation, in which case it should be reported with an 8% computation. Taxpayer Identification Number (TIN) You will receive a TIN from the IRS automatically as your 1099-R file is completed; it is not an IRS tax form. Your 1099-R must include your TIN. For the tax year you receive your check, enter the TIN of the person you are sending or receiving the money to. IRS Form 1099-R (Roth) 16 Dec 2025 — Enter “T.” (no spaces) to report a Roth IRA distribution from a Roth IRA. 20 Dec 2025 — Enter “R” to report a Roth IRA distribution from a Roth IRA of which a portion is not part of a qualified plan. 20 Dec 2025 — Enter “N” to report a Roth IRA to which a portion can be withdrawn without penalty, if the account has been in a taxable year for more than three consecutive months. Form 1099-B (Roth IRA) 19 Dec 2025 — Enter “T.” You may also need to enter “R.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form What is IRS 1099r, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form What is IRS 1099r online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form What is IRS 1099r by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form What is IRS 1099r from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-r distribution code 1m