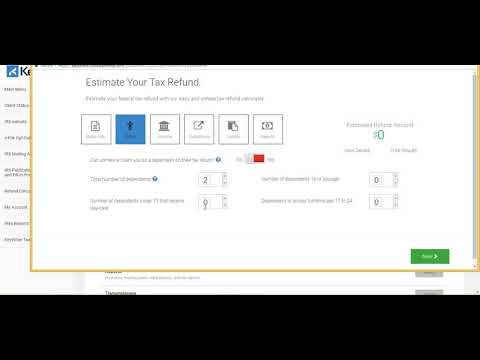

Everyone, thanks for joining me again today. - I'll be showing you how to do an efor your client. - If your client comes in and just wants to get a brief eand kind of see what they're looking at as far as a tax return, you can do that from here. - This is your client dashboard and over here to the left hand side, this refund calculator. - We're going to click here and you're just going to answer these questions about the tax return with the client. - If the client has dependents, what the client made for the year justice so you can go ahead and get it is efor that client. - So we're going to enter age here. - If you're married, click yes. - File a head of household, we're going to go ahead and click yes here. - Qualify widower, no. - Click Next. - Cancel on claim you as a dependent, no. - If you have dependents, with your number of dependents there, so I'm going to put two there. - Now your other questions populate squ questions about the dependent number of dependents that receive daycare. - If you have paying take care for any of the dependents, you can put that number here. - The total number of dependents that's under the age of 16 and if the dependent is a full-time student. - So if they're under 16, they're not a full-time student, that refers to a college student. - We're going to click Next here. - Inter taxable wages, you want to put 24,000. - Federal withholdings, going to put about 10% of that. - State, if there were any, was just gonna leave there. - For unemployment income, you see here we've already populated a eso...

Award-winning PDF software

1099 R tax calculator Form: What You Should Know

AF Form 1206: Fill out & use this PDF — Formal AF Form 1206 — Fallout and Use — This PDF File AF Form 1206 — Fill out and use — This PDF File AF Form 1206 — Fill out, and use this PDF -- Formal The AF form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed AF Form 1206 — Fill out, and use — This PDF File The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work. It can also be used by self-employed The AF Form 1206 is a form that needs to be filed by any organization that has employed or paid someone for work.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form What is IRS 1099r, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form What is IRS 1099r online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form What is IRS 1099r by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form What is IRS 1099r from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 R tax calculator